SR Flex

Overview

SR Flex is a database that contains tables related to FLEX options. Clients can view live FLEX market data and price FLEX spreads. Key features include:

- Live FLEX Option Prints

- Pricing of multi-leg FLEX option strategies

- Support for variable-strike legs to target a desired spread premium

SR Flex Tables

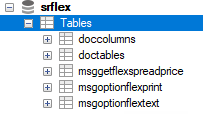

The following image shows the available tables in SR Flex:

Query Examples

Note:

These examples are not meant to be used as actual working queries.

GetFlexSpreadPrice Table

GetFlexSpreadPrice is a live calculator that enables real-time pricing and risk analysis of multi-leg FLEX option strategies. It supports option spreads where the user can set a desired target premium (e.g., for zero-collar spreads), by designating (at most) one leg to have a variable strike that is solved for in order to deliver this target.

For more detailed information on input parameters, leg definitions, and returned values, refer to the GetFlexSpreadPrice documentation.

Sample Query 1: Insert values to price a FLEX call spread with a variable strike leg:

INSERT INTO srflex.msggetflexspreadprice

(userName, calcId, uPrc, fixedPremUPct, incGreeks, ticker_at, ticker_ts, ticker_tk, TIMESTAMP, DiscreteDividendList, LegsList)

VALUES

('user.name', 0, 0.0, 2.0, 'Yes', 'EQT', 'NMS', '1AAPL', CURRENT_TIMESTAMP(6), '[]',

'[{"okey":{"at":"EQT","ts":"NMS","tk":"1AAPL","dt":"2026-02-13","xx":260,"cp":"Call"},

"ratio":1,"side":"Buy","strikeType":"DollarAmt"},

{"okey":{"at":"EQT","ts":"NMS","tk":"1AAPL","dt":"2026-02-13","xx":0,"cp":"Call"},

"ratio":1,"side":"Sell","strikeType":"PctVariable"}]');